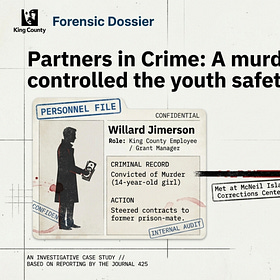

King County Auditor Blows Whistle: Millions Missing, Billions at Risk in DCHS Fraud Scandal

Report details massive grant fraud inside King County department. Auditor finds lack of internal controls, poor oversight, kickbacks, fraud, embezzlement and rampant criminality. J425 summary.

SEATTLE – An audit conducted by the King County Auditor’s Office, released in August 2025 and updated in September 2025, reveals significant deficiencies in the financial stewardship of the Department of Community and Human Services (DCHS).

Amid rapid growth, with grant funding doubling from $922 million in 2019-2020 to over $1.8 billion in 2023-2024, DCHS failed to consistently apply internal controls. This resulted in improper payments, including instances of potential fraud, waste, and abuse across multiple programs.

The audit finds that DCHS strategically accepted greater financial risk to lower contracting barriers for smaller organizations with limited government experience. You may read the audit here.

However, the department has not adequately managed this risk, revealing critical gaps in enforcing contract terms, validating invoices, managing documentation, and communicating expectations to staff and grantees. Nearly half of the 359 grantees reviewed in 2024 were scored as high-risk.

(Audit summary continues below insert.)

Read the J425 Analysis/Commentary on this Issue:

The Billion-Dollar Bypass: King County's DCHS is Either an Innovation in Patronage...or a Perfect Storm of Fraud

SEATTLE – Tens of millions already lost to graft, corruption and theft. Authorized attempts to institute much-needed financial controls are met with internal indifference. As funds blow out the door by the hundreds of millions…

Key issues identified include a lack of documented policies and procedures for invoice validation, insufficient oversight of high-risk expenses like stipends and prepaid cards, and inconsistent handling of subcontracts and overpayments. The audit also highlights a departmental culture that may prioritize relationships over accountability, a lack of anti-fraud training, and ineffective use of capacity-building programs for financial management.

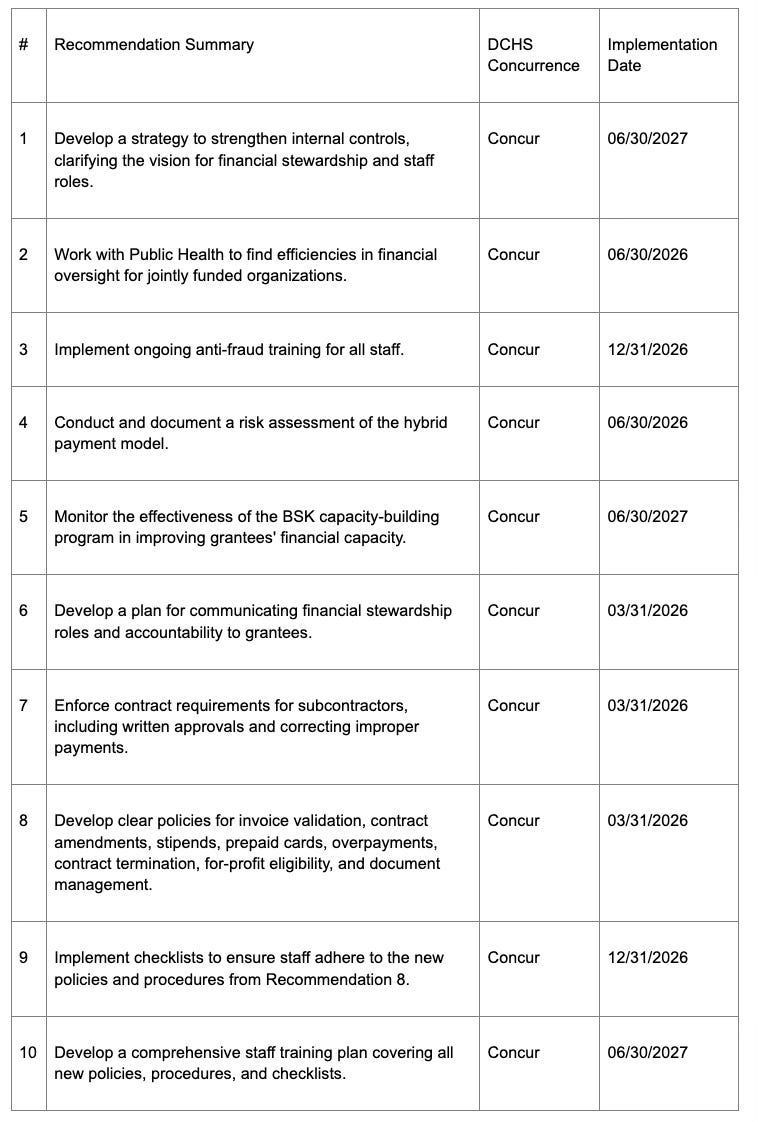

The Auditor’s Office issued ten recommendations to strengthen DCHS’s internal control framework, improve financial oversight, and ensure staff have the necessary guidance and tools.

The King County Executive and DCHS have concurred with all ten recommendations and provided a timeline for implementation.

Absence of Financial Stewardship; Lack of Internal Controls Plague Department

Rapid Growth and Increased Financial Risk

The audit underscores the immense growth in DCHS’s financial responsibilities. The department awarded 87% of all active county grants as of April 2025 and manages five significant tax-levy funding sources, including the Best Starts for Kids and Crisis Care Centers levies. This expansion, particularly accelerated by the COVID-19 pandemic response where the focus shifted to “speed over the need to prevent fraud,” has created a high-risk environment.

Grant Funding Expansion: DCHS grant awards increased from $922 million in 2019-20 to $1.41 billion in 2021-22, and over $1.8 billion in 2023-24.

High-Risk Grant Portfolio: In its 2024 annual risk assessment, DCHS classified 48% of its 359 grantees as high-risk. Higher risk is assigned to entities with less experience with government funding, fewer fiscal resources, and limited internal policies.

Independent Procurement: DCHS runs its own procurement processes for community grants, placing them outside the scope and independent oversight of King County’s central procurement group.

Deficiencies in Internal Controls and Oversight

Despite the high-risk environment, DCHS has not developed a robust system of internal controls. The audit found that the department lacks a comprehensive strategy to embed financial stewardship into its culture, leading to significant gaps in risk identification and control activities.

Insufficient Fiscal Monitoring: DCHS failed to meet its own policy standard of conducting fiscal site visits for grantees at least once every three years (a 33% annual rate).

2022: 2% of grantees monitored

2023: 1% of grantees monitored

2024: 16% of grantees monitored

2025: A plan is in place to monitor 20%

Staffing and Workload Issues: The compliance team has been understaffed, starting 2022 with five staff and ending with two. Staff reported that high workload and difficulty defining the role’s required skills made hiring and retention difficult. While three new positions were added in 2025, the workload for the existing team was described as “excessive.”

Lack of Coordination: DCHS does not routinely coordinate with Public Health–Seattle & King County on fiscal site visits for organizations funded by both departments (e.g., through Best Starts for Kids), creating redundancies and inefficiencies.

No Fraud or Risk Management and Staff Training

The audit identified a culture at DCHS that may signal “that relationships are more important than accountability.” This has limited the effectiveness of fraud prevention and detection.

Limited Fraud Awareness: Interviewed DCHS staff rarely expressed concern about fraud risk.

Absence of Training: DCHS does not provide department-wide anti-fraud training, a best practice for reducing losses and improving detection speed. The only exception is for staff in the Behavioral Health and Recovery Division who manage federal Medicaid funds.

Ethical Lapses: The audit found an incomplete financial disclosure form, limiting transparency on a potential conflict of interest. A supervisor was aware of the potential conflict but did not escalate the issue appropriately.

General Training Gaps: In a 2025 survey, only 50% of DCHS employees agreed they had the training needed to do their jobs effectively, 15 percentage points below the King County average.

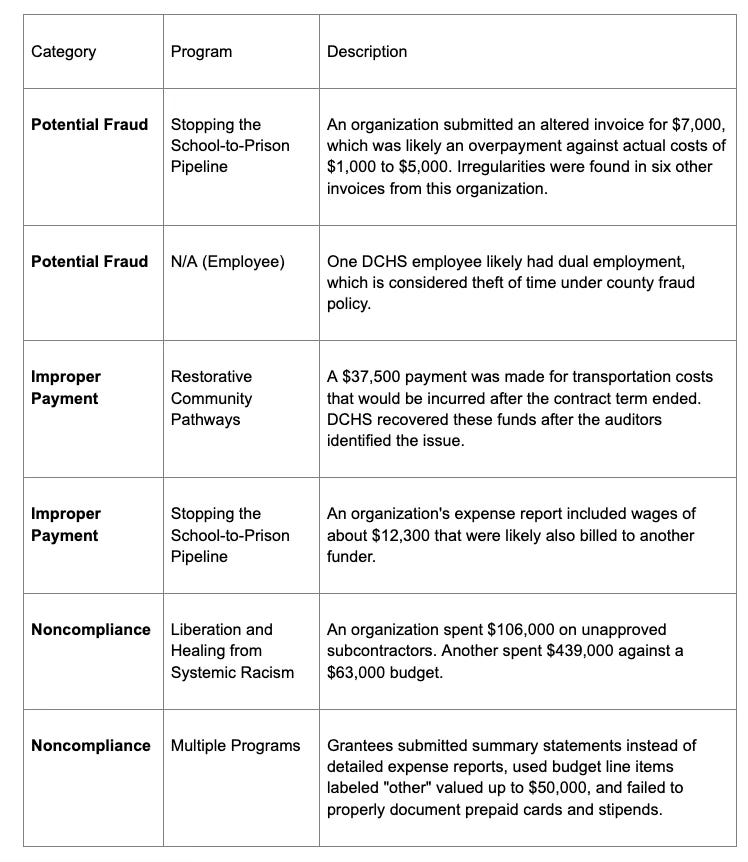

Analysis of Improper Payments and Noncompliance

The lack of clear policies, procedures, and training has directly contributed to improper payments and noncompliance with contract terms. The audit found systemic issues in how DCHS validates invoices and manages contracts.

Systemic Issues in Invoice and Contract Management

Inconsistent Invoice Vetting: DCHS lacks written policies and procedures for invoice review. Staff typically limited their review to expense reports without requesting supporting documentation like receipts, leading to the approval of improper payments.

Poor Document Management: Staff commonly kept critical documents like expense reports in email instead of approved, accessible systems. The audit found 14 of 39 tested grantees had no financial statements on file with DCHS compliance, and grantee responsiveness to information requests was low.

Unenforced Subcontracting Terms: DCHS did not consistently enforce contract requirements for subcontractors.

One organization with a $63,000 subcontracting budget spent $439,000 (43% of its total budget) on subcontractors without a contract amendment.

Another organization spent $106,000 on unapproved subcontractors despite having no budget allocated for them.

Lack of Clear Guidance: DCHS has no documented criteria for when budget deviations require a formal contract amendment or when contract nonperformance warrants termination, increasing the risk of inconsistent treatment.

High-Risk Spending and Oversight Failures

The audit revealed insufficient oversight for expenses that are at a higher risk of misuse, such as stipends and prepaid cards.

Uncapped Stipend Payments: DCHS did not ensure stipends were reasonable, increasing the risk of them being considered a prohibited gift of public funds.

One person received more than $15,000 in monthly stipends in 2023 and 2024.

Insufficient Prepaid Card Tracking: DCHS staff did not regularly request or review prepaid card logs as required by contracts. None of the five logs reviewed by the auditors contained all required elements (e.g., signatures of distributors and recipients), meaning DCHS may have made improper payments.

Documented Instances of Criminal Fraud and Noncompliance

The audit identified specific instances of improper payments and actions that constitute likely fraud or noncompliance under Government Auditing Standards.

Specific Payment Models and Programs of Concern

The “Hybrid” Payment Model

DCHS utilizes a “hybrid” payment model for 14% of its contract payments ($960 million total in 2024). This model was designed to provide grantees with stable, predictable funding but has heightened financial risk.

How it Works: DCHS pays grantees a set monthly amount based on their contract budget but only receives expense reports quarterly. Reconciliation of payments to actual expenses begins after several payments have already been made.

Increased Risk: This model means DCHS makes payments before knowing if funds are being used for allowable costs. DCHS also conducts its risk assessments the year after payments begin, meaning it issues funds without proactively assessing a new grantee’s financial capacity.

Lack of Formal Assessment: DCHS has not conducted a documented risk assessment of the hybrid model to ensure it adequately mitigates the risks of fraud and overpayment.

Best Starts for Kids (BSK) Program Insights

The audit examined programs funded by the Best Starts for Kids levy and found that a key support mechanism is underutilized.

Capacity-Building Program: DCHS allocates $1 million annually from the BSK levy to a capacity-building program offering free consulting services to grantees.

Low Usage for Financial Support: Despite grantees expressing a need for financial management support, financial consulting accounted for only 6% of the 22,825 consulting hours used between 2022 and 2024. Organizational Development was the most used service at 42%.

Effectiveness Unknown: DCHS does not measure the program’s impact on grantees’ financial capacity, so its effectiveness in reducing financial risk is unclear.

Auditor’s Recommendations and Executive Response

The audit report identified nineteen instances of probable criminal fraud requiring further investigation, and provided ten recommendations aimed at creating a robust framework for financial stewardship. King County’s Office of Performance, Strategy and Budget, on behalf of the Executive and DCHS, submitted a response concurring with all ten recommendations and outlining an implementation plan. The new Executive is required to reply by the end of March.

Wow, this is the kind of accountability reporting we need. It's wild how a department can go from $922M to $1.8B in grant funding with basically zero oversight and think that's sustainable. I used to work in nonprofit grant managment and the idea of monitoring only 16% of grantees when your target is 33% would have gotten our whole team fired immedietly. Those prepaid card logs with no signatures are red flags that've been waving for years.